The $10 million payment is acknowledged on page 14 of the Division G Explanatory Statement for the FY 2021 appropriations bill.

Those funds, derived from grazing fees, are plowed back into the program every year to make life better for the public-lands ranchers. Refer to paragraph (b)(1) in Section 1751 of the Federal Land Policy and Management Act (the ‘No Rancher Left Behind Act’).

Money to remove animals that rob forage from the ranchers, such as wild horses and burros, is discussed on page 13 of the statement. Taxpayers provide those funds.

The current fee is $1.35 per AUM, determined by a formula in Section 1905 of the Public Rangelands Improvement Act. Note that the base fee, $1.23 per AUM, was set in 1966.

Section 3.2.8 in the Draft EA for resource enforcement actions in the Desatoya HMA notes that the value of grass hay in Nevada is $68 per AUM.

That means the ranchers are paying two cents on the dollar to feed their livestock, even on lands set aside for wild horses and burros.

Paragraph (a)(9) in Section 1701 of FLPMA says the United States shall receive fair market value for the use of the public lands and their resources, unless otherwise provided by statute, which in the case of livestock grazing is PRIA.

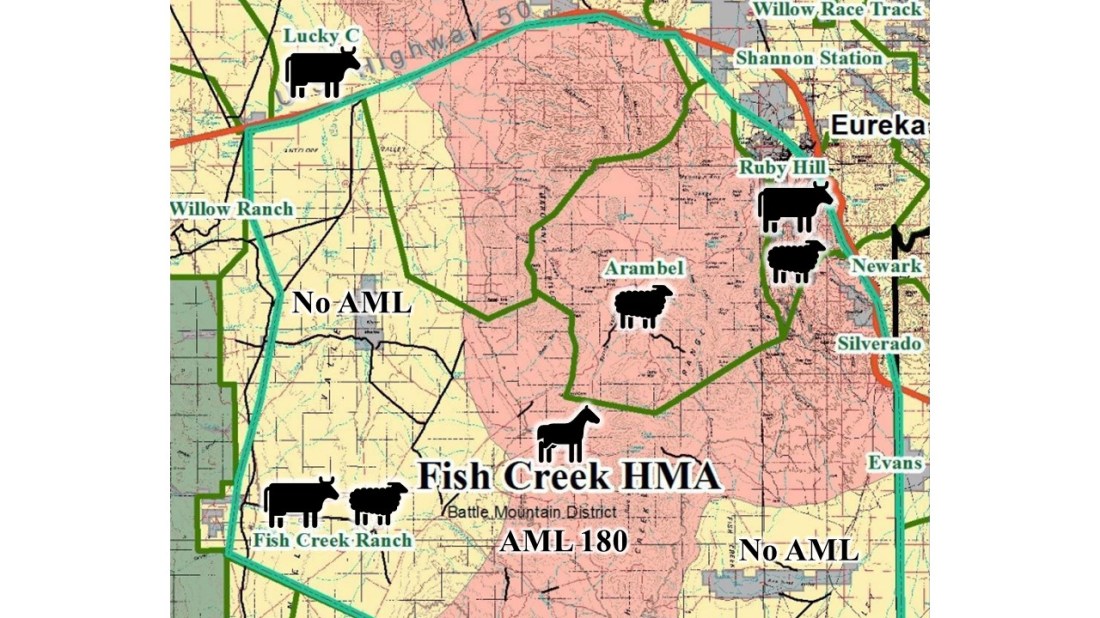

Now you know why there is so much interest in achieving and maintaining AMLs, the goal of the rancher-friendly ‘Path Forward.’

What would happen if grazing fees reflected market conditions?

Table 3-3 in the EA provides costs associated with roundups and off-range holding.

In the discussion that follows, the present value of gathering and holding an animal over a 25 year period was estimated to be $15,950. The present value of the benefits arising therefrom—forage available to privately owned livestock over the same period—was estimated to be $14,209.

The present value of the costs exceeds the present value of the benefits, meaning it’s a bad investment. Nobody in the private sector would do it.

But insulating the ranchers and their overlords from the realities of a free market is what the grazing program is all about.

If grazing receipts were used in the benefit calculation ($1.35 per AUM), instead of avoided costs ($68 per AUM), the present value would be nil and the proposal would never even see the light of day.

RELATED: Grazing Program Ancillaries.